Income Tax Bill 2025 brings major changes—new “Tax Year” concept, stricter TDS rules, revised capital gains & tighter compliance norms. Businesses and investors must prepare early.

.

Stay informed. Stay compliant.

.

#IncomeTaxBill2025 #TaxReformsIndia #IndiaTax #TaxUpdates #TaxCompliance #TaxPlanning #globaljurix

#TaxUpdates

Income Tax Act 2025 brings clarity and simplicity for taxpayers and businesses. Learn about simplified forms, clearer rules, and smoother compliance from April 1, 2026 🚀📊💼✅ Stay informed with key updates. (Read more) https://www.setindiabiz.com/blog/new-income-tax-2025-key-updates-explained

#Setindiabiz #IncomeTax2025 #TaxUpdates #BusinessCompliance #IndiaTax

CBDT clarifies reasons behind income tax refund delays 🧾✨🌐📊 Check how high-value and flagged cases impact timelines and when you can expect your refund.

Read more: https://www.setindiabiz.com/blog/cbdt-explains-income-tax-refund-delays-timeline

ITR refund delayed? CBDT explains why and when you’ll finally get it https://english.mathrubhumi.com/news/money/itr-refund-delayed-cbdt-explains-why-and-when-youll-finally-get-it-vez6bfbj?utm_source=dlvr.it&utm_medium=mastodon #ITRRefund #IncomeTaxIndia #CBDT #TaxUpdates #FinanceNews

The GST Portal introduces a new "Import of Goods" section in the Invoice Management System. 📋 Bill of Entry details for imports, including SEZ, will be available from Oct-2025. 💼 This enhancement streamlines ITC compliance for businesses. 🚢✨ Read more: https://www.setindiabiz.com/blog/new-import-of-goods-section-launched-on-gst-portal

#GSTCompliance #ImportManagement #TaxUpdates #BusinessEfficiency #Setindiabiz

Tablesacyj تغيرات في_IEEE alendar Starting October 1st Hutchinson_library στις £ advising about sales tax updates for US SaaS businesses starting October 1st, 2025. These changes include expansions of taxable services in Washington, repeal of commercial rental tax in Florida, and tax rate updates in 15+ states. The post provides detailed information about each state's changes and advises businesses to update their tax software to avoid potential auditing issues. #SalesTax #TaxUpdates #SaaS #Busi

ITR: Income Tax Department's strictness on exempted income

https://hindi.vaartha.com/itr-income-tax-departments-strictness-on-exempted-income/business/61405/

#IncomeTax #ITR #IncomeTaxDepartment #TaxCrackdown #TaxEvasion #ExemptedIncome #TaxCompliance #TaxFraud #TaxDeductions #TaxExemptions #TaxReturn #TaxInvestigation #TaxAuthorities #TaxAudit #FinanceMinistry #CBDT #TaxLaws #TaxPolicy #TaxRegulations #TaxUpdates

📌 GSTR-1 due date for June 2025 is 11th July 2025. Applicable for taxpayers with turnover above ₹5 crore or those not opted for QRMP for Apr–Jun 2025 quarter.

#GSTR1 #GSTCompliance #OutwardSupply #GSTReturn #DueDateReminder #Finance #TaxUpdates

Ask ChatGPT

🔔 Due date for TDS payment (Q1: Apr-Jun 2025) under sections 192, 194, 194D, or 194H (if AO permitted quarterly payment) is 7th July 2025.

#IncomeTax #TDSCompliance #CharteredAccountants #TaxUpdates #Finance #Accounting #TDSReminder

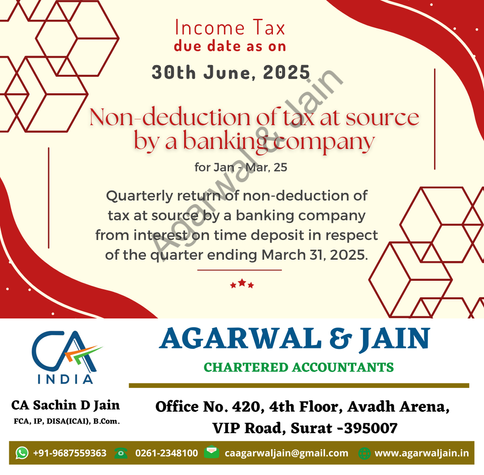

📌 Due date: 30th June 2025

Quarterly return for non-deduction of TDS by a banking company on interest on time deposits for the quarter ending 31st March 2025.

#IncomeTax #TDS #TaxCompliance #Form26QAA #BankingCompliance #TaxUpdates #DueDateReminder

🗓️ IFF for May 2025 is due on 13th June 2025.

IFF is an optional facility under GST for small registered persons filing quarterly GSTR-1, to furnish invoice details monthly.

#IFF #GSTIndia #GSTR1 #GSTCompliance #InvoiceFurnishing #TaxUpdates #DueDateReminder

Wondering about a 'new Income Tax Act, 2025'?

As of May 2025, India still follows the Income-tax Act, 1961. No new act has been enacted. Key reforms include:

✅ Optional tax regime (Section 115BAC for individuals, 115BAA for companies)

✅ Faceless assessments for transparency

✅ Digital tools for faster refunds & e-filing

Talks of a Direct Tax Code continue, but nothing’s confirmed yet. Stay tuned for updates from the Ministry of Finance!

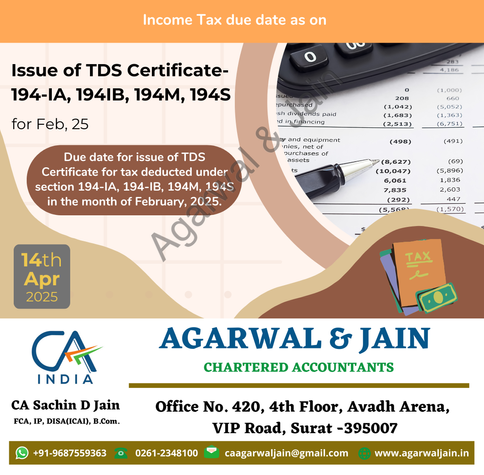

Due date for issue of TDS certificate for tax deducted u/s 194-IA, 194-IB, 194M, 194S during Feb 2025 is 14th April 2025. Ensure compliance within time to avoid interest and penalties. #IncomeTax #TDS #Compliance #Finance #TaxUpdates #IndiaTax #194IA #194IB

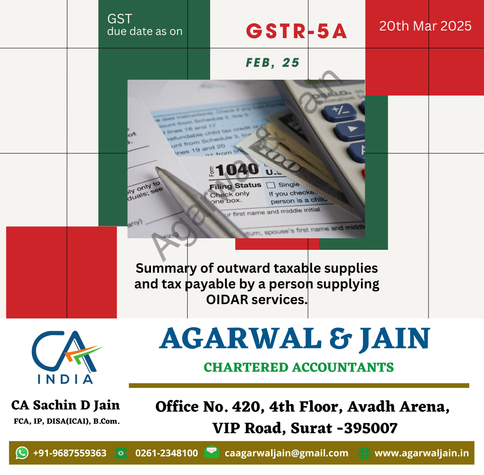

📢 GSTR-5A Due Date Alert: The filing deadline for GSTR-5A for February 2025 is 20th March 2025. This return is applicable for OIDAR service providers to report outward taxable supplies & tax payable. Stay compliant! ✅ #GST #TaxUpdates #Compliance #GSTR5A #OIDAR

📢 Reminder: The due date for issuing TDS Certificates (194-IA, 194-IB, 194M, 194S) for tax deducted in Jan 2025 is 17th March 2025. Ensure timely compliance. ✅ #IncomeTax #TDS #TaxUpdates #Finance #Compliance

📢 GST Due Date Reminder

📌 GSTR-1 for Feb 25

📅 Due on 11th March 2025

Outward supplies return for taxpayers with turnover above ₹5 Cr or those not opted for the QRMP scheme for Jan-Mar 2025. Stay compliant.

📅 GST Due Date Reminder

🔹 GSTR-5A for January 2025

📌 Due on 20th February 2025

📌 Applicable for OIDAR service providers to report taxable supplies & tax payable.

Stay updated on compliance deadlines!

📅 GST Due Date Reminder

🔹 IFF for Jan 25 due on 13th February 2025

📌 Optional facility for small taxpayers filing GSTR-1 quarterly

📌 Enables monthly invoice furnishing

Stay informed about tax compliance!

Reminder: The due date for TDS/TCS payment for January 2025 is 7th February 2025. Ensure timely compliance to avoid any interest or penalties. Stay updated with key tax deadlines! #TDS #TCS #TaxUpdates #Compliance #Finance #IncomeTax #Deadlines

📢 Union Budget 2025-26: Key tax compliance updates!

🔹 Small charitable trusts get a registration period boost—now 10 years.

🔹 Taxpayers can claim two self-occupied properties as nil.

🔹 Updated IT return filing time extended to 4 years.

#UnionBudget #TaxUpdates #Finance